nashi Team

5 min read

Choosing a payment gateway partner is a critical step for your Singaporean business. A payment gateway is the technology that securely processes customer card and digital wallet payments for online and in-store checkout. It impacts your customer's checkout experience and your daily cash flow. This guide cuts through the noise to help you decide.

We’ve created a practical roundup of the best payment gateway providers in Singapore. This list is specifically for micro and small businesses. We cover everything from CBD cafés to weekend market and pop up stalls.

This guide focuses on what truly matters to a small business owner. We dive into pricing, onboarding speed, hardware needs, and contract terms. Let's find the perfect payment partner for your business.

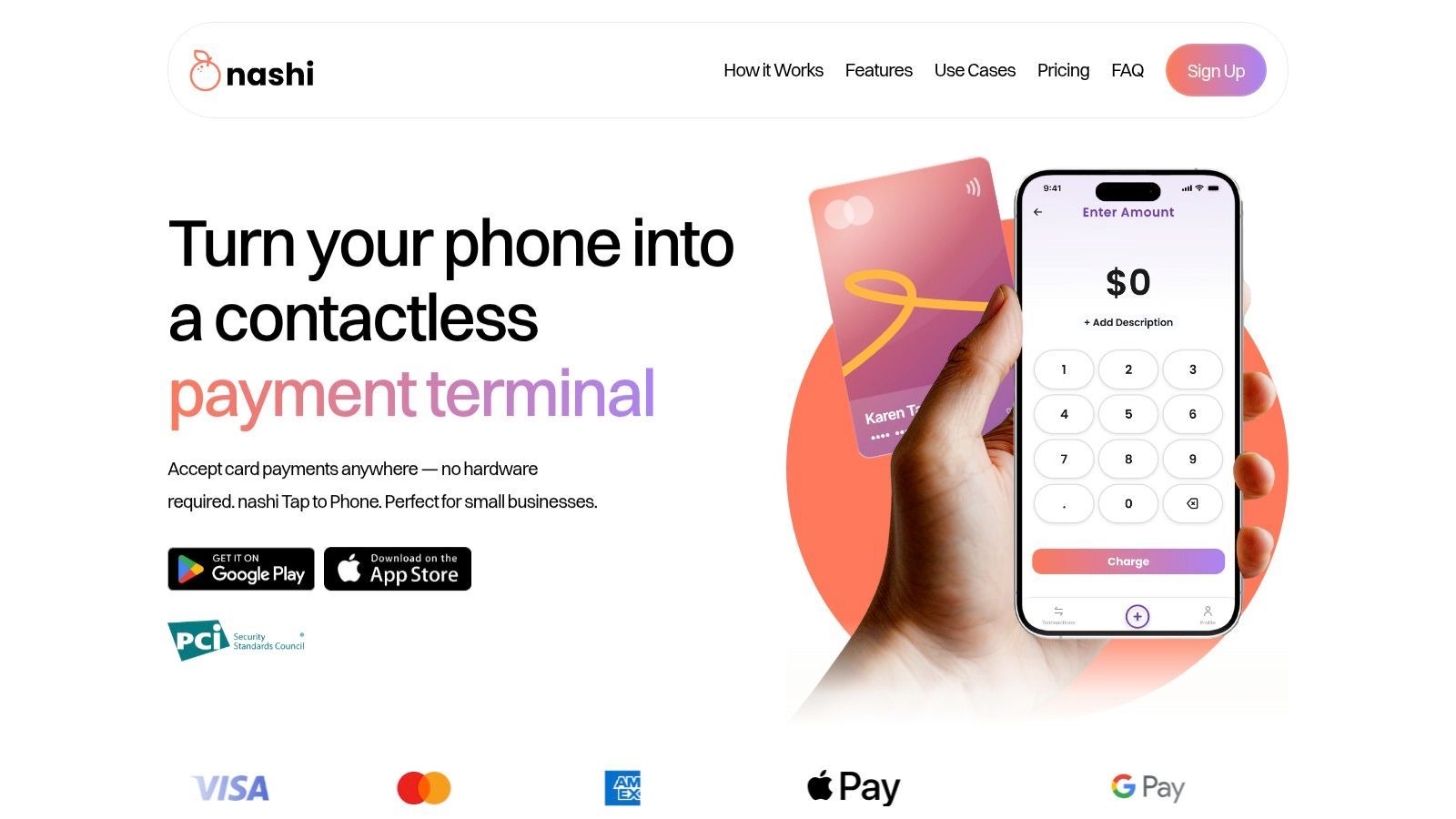

1. nashi

Best for: Micro-merchants, pop-ups, and service professionals needing a fast, hardware-free way to accept in-person card payments.

nashi transforms any NFC-enabled smartphone into a secure contactless card terminal. It solves a major pain point for micro-businesses by eliminating hardware rentals and long-term contracts. This mobile-first solution makes in-person card payments incredibly simple.

The platform is built for merchants who value speed over complex POS features. Onboarding is digital and quick, often completed within one business day. You can start accepting Visa, Mastercard, and AMEX payments almost immediately.

Why It Stands Out

nashi stands out for its intentional simplicity and transparent model. It avoids feature bloat like inventory management to deliver a reliable payment experience. It's designed to work fast every time, a critical factor for busy merchants.

The pricing is clear and published directly on their site. This is a refreshing change from the opaque, quote-based models many providers use. It runs on enterprise-grade Adyen infrastructure, offering top-tier security without complexity.

Key Details & Pricing

Feature | Details |

|---|---|

Transaction Fees | Starter: 1.99% + S$0.30 (for new card acceptors) Standard: 2.7% + S$0.30 |

Monthly Fees | S$0 |

Hardware Costs | S$0 (uses your existing NFC-enabled smartphone) |

Onboarding Time | Approx. 1 business day |

Settlement Time | Approx. 2 business days to your bank account |

Pros

No Hardware Needed: Eliminates terminal rental fees and delivery waits.

Rapid Onboarding: Digital setup gets you started in about one business day.

Transparent Pricing: Clear rates with a generous fee-free introductory offer.

Built for Micro-Merchants: Optimised for pop-ups, freelancers, and small shops.

Cons

In-Person Only: Not designed for e-commerce or online payment processing.

Limited Features: Intentionally lacks inventory or advanced POS tools.

Device Dependent: Requires a compatible NFC-enabled smartphone.

For a deeper dive into how this SoftPOS solution can streamline your sales, you can learn more about nashi and its features.

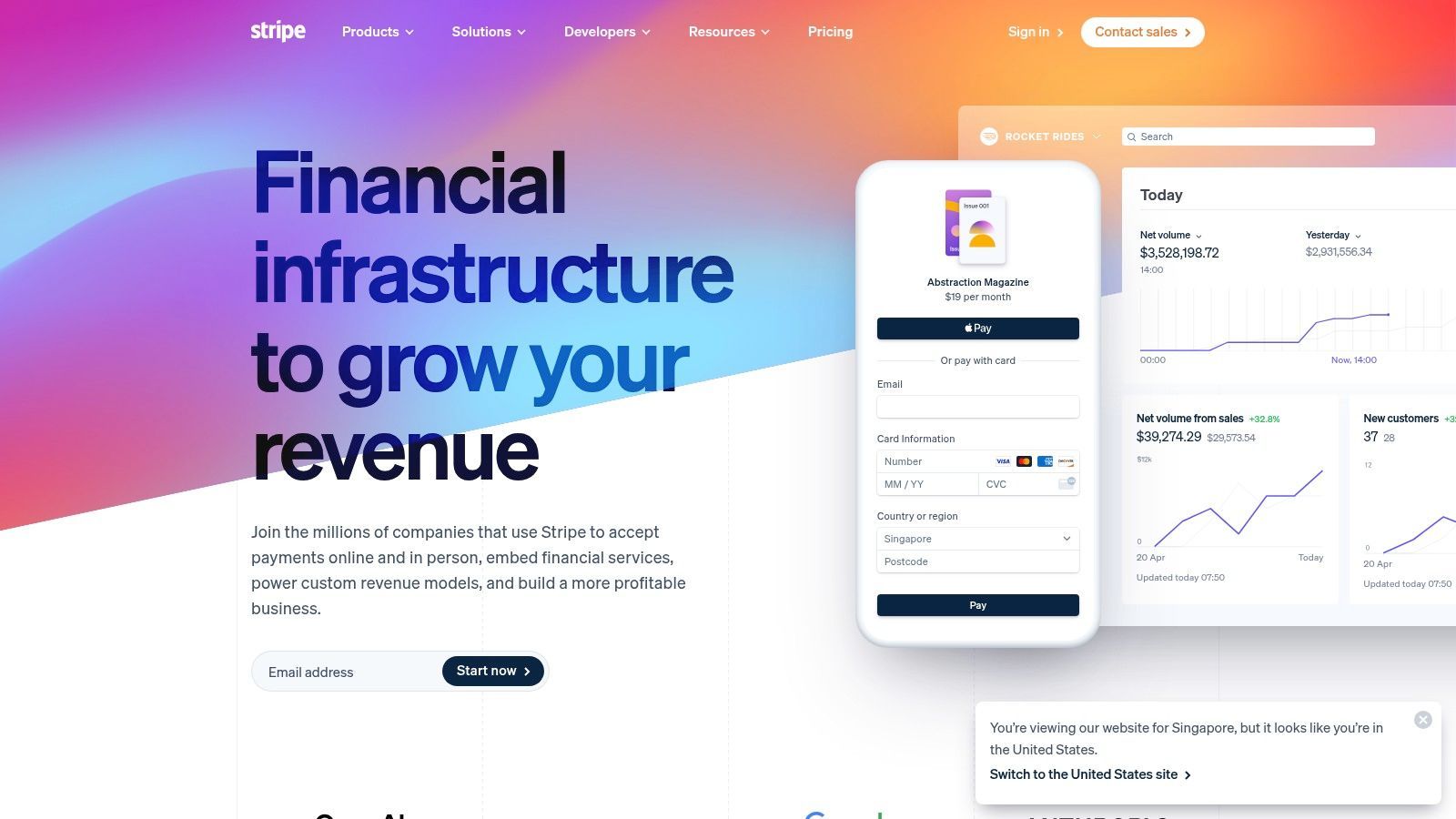

2. Stripe

Stripe is the gold standard for developers and online businesses. Its Singapore offering is also powerful for small in-person retailers. It blends a developer-centric API with simple, no-code tools.

You can use their Tap to Pay feature on a compatible iPhone or Android device. This turns your phone into a card terminal without extra hardware. It's perfect for accepting payments on the go.

Stripe's transparent, pay-as-you-go pricing and rapid onboarding set it apart. You can create an account and accept payments the same day. Support for local methods like PayNow and GrabPay is a huge plus.

Key Features & Verdict

Pricing: 3.4% + S$0.50 per successful card charge; 1.3% for PayNow.

Onboarding: Typically under 24 hours for online self-signup.

Hardware: Optional. Supports Tap to Pay and card readers.

Contract: None.

Verdict: The champion for tech-savvy startups and e-commerce stores needing a flexible, scalable solution without upfront costs or hardware commitments.

3. Adyen

Adyen is an enterprise-grade platform for established Singaporean SMEs. It combines payment gateway and acquiring services, simplifying the entire payment flow from checkout to settlement.

Adyen uses a transparent Interchange++ pricing structure that breaks down every transaction cost. It can be more cost-effective for businesses with high processing volumes.

Its single platform manages payments across e-commerce, mobile apps, and retail stores, streamlining operations for growing retailers.

Key Features & Verdict

Pricing: Custom Interchange++ pricing

Onboarding: Sales-led, slower than self-signup

Hardware: Modern POS terminals available

Contract: Custom terms

Verdict: Best suited for high-volume, growth-focused businesses that need a unified, enterprise-grade platform.

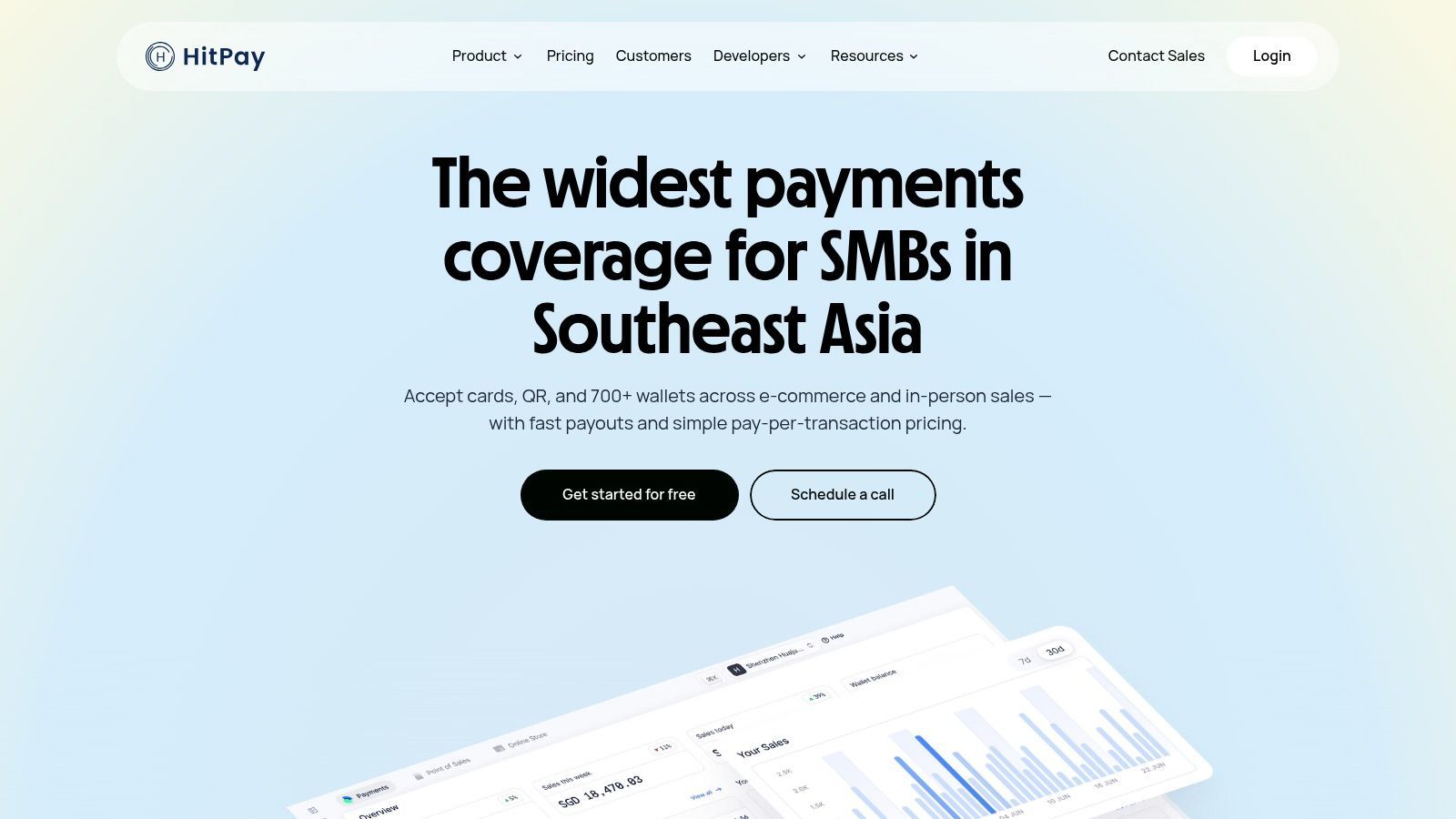

4. HitPay

HitPay is designed specifically for local SMEs in Singapore. It offers an all-in-one solution combining online and offline payments.

HitPay integrates with Shopify and WooCommerce without requiring a developer. For physical stores, it also offers optional card terminals.

Key Features & Verdict

Pricing: 0.80% + S$0.30 for PayNow; from 2.69% + S$0.30 for cards

Onboarding: Fast and self-service

Hardware: Optional

Contract: No lock-in

Verdict: Ideal for SMEs needing PayNow, cards, and simple e-commerce integrations in one local platform.

5. PayPal

PayPal is a globally recognised payment provider, particularly strong for international transactions.

It offers invoicing and subscription tools useful for freelancers billing overseas clients. However, fees can be higher for local use.

Key Features & Verdict

Pricing: ~3.9% + fixed fee

Onboarding: Fast online signup

Hardware: None

Contract: None

Verdict: Best used as a secondary gateway for international payments rather than a primary local solution.

6. NETS (eNETS, SGQR, NETS SoftPOS)

NETS is Singapore’s national payments network and a cornerstone of local commerce.

Its SGQR and SoftPOS solutions allow merchants to accept a wide range of local payment methods.

Key Features & Verdict

Pricing: Varies by bank partner

Onboarding: Through DBS, OCBC, or UOB

Hardware: Optional

Contract: Often required

Verdict: Good for traditional retail and hawker businesses serving local customers.

7. Shopify Payments

Shopify Payments is the most seamless option for businesses already using Shopify.

It supports online and in-person payments with transparent pricing tied to your Shopify plan.

Key Features & Verdict

Pricing: 3.4%–3.1% + S$0.50 depending on plan

Onboarding: Instant activation

Hardware: Optional

Contract: Linked to Shopify subscription

Verdict: The default and simplest choice for Shopify merchants.

FAQ: Choosing a Payment Gateway in Singapore

What is the cheapest payment gateway in Singapore?

The is no single cheapest option. Cost depends on transaction volume, payment types and business requirements.

Can I accept payments without a physical terminal?

Yes. SoftPOS and Tap to Phone solutions allow compatible smartphones to act as terminals.

Do I need to register a business?

Yes. All providers require an ACRA-registered business entity.

How quickly can I start accepting payments?

Fintech providers may approve accounts within one business day. Bank-led solutions take longer.

What’s the difference between a payment gateway and a payment processor?

A gateway captures payment data, while a processor moves funds between banks. Some providers offer both in one platform.

Ready to simplify your in-person payments with zero hardware?

nashi offers a seamless Tap to Pay solution right on your phone, perfect for Singapore's dynamic small businesses. Learn more here.