nashi Team

5 min read

Finding affordable credit card processing in Singapore often feels like a maze. Hidden fees and complex contracts make it hard to know what you are actually paying. Many small businesses stick with cash and PayNow, potentially missing sales.

This guide cuts through the noise. We demystify the real costs of accepting card payments in 2026. You'll learn how to find the cheapest credit card processing services for your business.

We will break down every critical element, from simple flat-rate pricing to more complex models. This guide will equip you to compare services like Stripe, HitPay, and innovative SoftPOS solutions like nashi. Get ready to find a solution that helps your business grow.

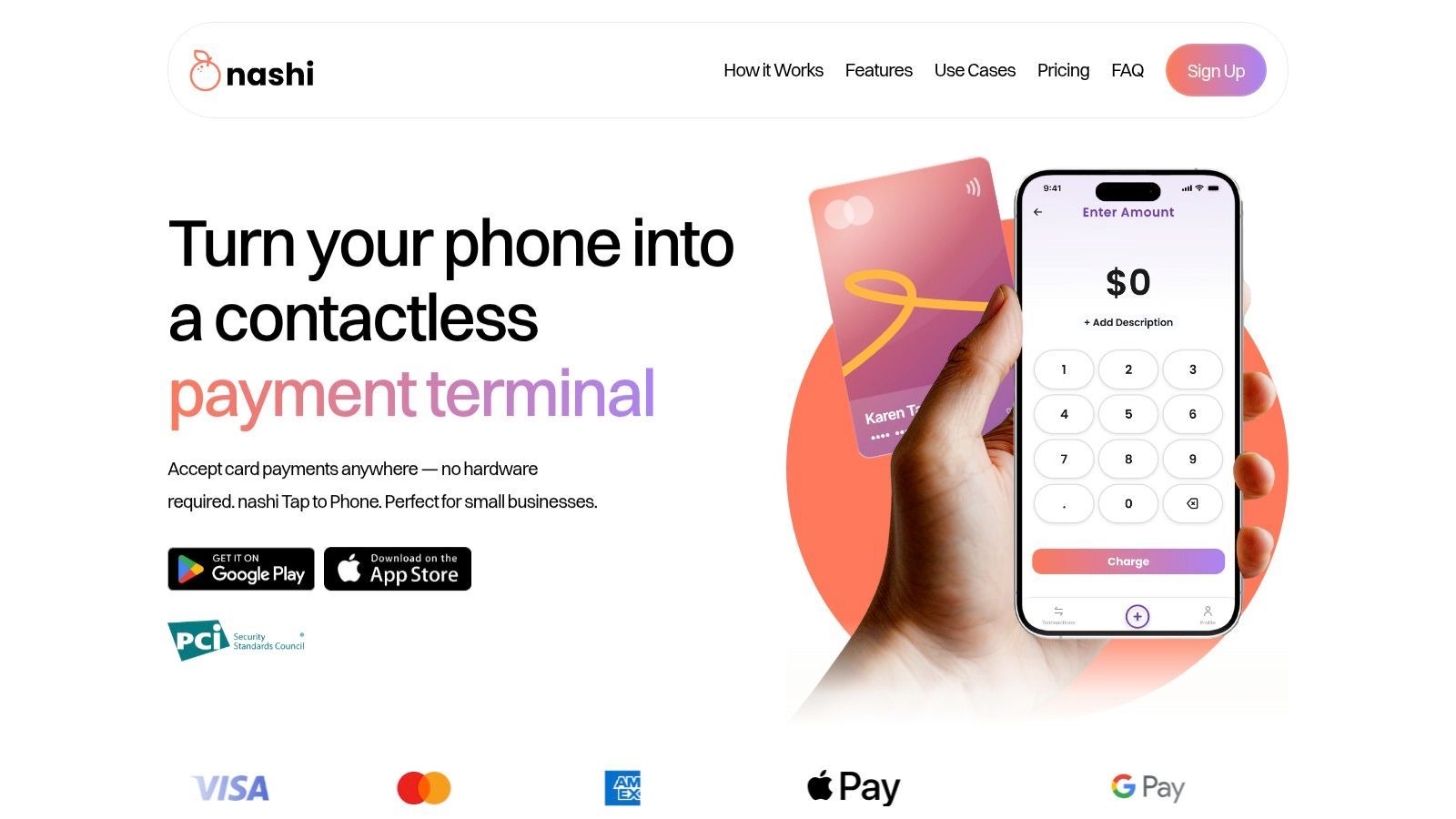

1. nashi

nashi is a streamlined solution designed for Singapore’s micro and small businesses. It strips away traditional complexities, turning any NFC-enabled smartphone into a secure payment terminal. This hardware-free approach makes it an exceptionally cost-effective choice.

The core proposition is simple: no terminals to rent and no lengthy contracts. For market vendors and mobile service providers, this eliminates significant upfront costs. You can complete the digital onboarding in about a business day and start accepting payments.

Key Strengths & Use Cases

nashi's strength is its focused design. It perfects one crucial function: fast, reliable, in-person card acceptance. It is not an all-in-one POS system.

This focus makes it ideal for specific business models:

Pop-ups and Market Stalls: Accept payments instantly without needing a power source or counter space.

Mobile Service Providers: Collect payment on-site the moment a job is completed.

Pop up Food Stalls and Cafes: Speed up queues by allowing customers to tap their card on your phone.

New Entrepreneurs: Test a business idea without committing to expensive hardware.

The user experience is built for speed. A merchant enters the amount, the customer taps their card, and the transaction is complete. Funds are settled to your bank account, typically within two business days.

Transparent Pricing Built for Small Business

Cost is critical for small businesses, and nashi uses a transparent, pay-as-you-go model. There are zero monthly fees, no setup costs, and no hardware to purchase. This lowers the total cost of ownership compared to traditional providers.

The transaction fees are straightforward and published clearly:

Starter Rate: 1.99% + S$0.30 (for new card acceptors SG Visa/Mastercard)

Standard Cards: 2.7% + S$0.30 (SG Visa/Mastercard)

Premium Cards: 3.3% + S$0.30 (AMEX/International)

nashi also offers a limited time fee-free trial, waiving all fees on your first S$1,000 in sales. This lets new businesses experience card acceptance without initial cost. You only pay when you make a sale.

Key Insight: The absence of fixed monthly costs and hardware fees makes nashi's effective rate extremely competitive for businesses with fluctuating or lower transaction volumes.

Enterprise-Grade Security and Reliability

The technology behind nashi is robust and secure. It is built on the enterprise-grade payment rails of Adyen, a global leader in payments. The platform is fully PCI-DSS compliant.

This combination of a user-friendly app and a powerful backend provides peace of mind. As one user noted, nashi "works every time and it works fast." This is crucial for maintaining customer trust.

Pros:

Hardware-Free: Uses your existing NFC-capable phone.

Rapid Onboarding: Digital sign-up, often approved in one business day.

Transparent Pricing: No monthly fees, clear rates, and a fee-free trial.

Highly Secure: PCI-DSS compliant and powered by Adyen's infrastructure.

Purpose-Built for Mobility: Perfect for on-the-go merchants.

Cons:

In-Person Only: Does not support e-commerce or online payments.

Limited Features: No inventory management or advanced POS tools.

Device Dependent: Requires a compatible NFC-enabled smartphone.

For any Singapore-based entrepreneur seeking an affordable path to accepting in-person card payments, nashi is a compelling solution. You can learn more about its features and sign up on their website.

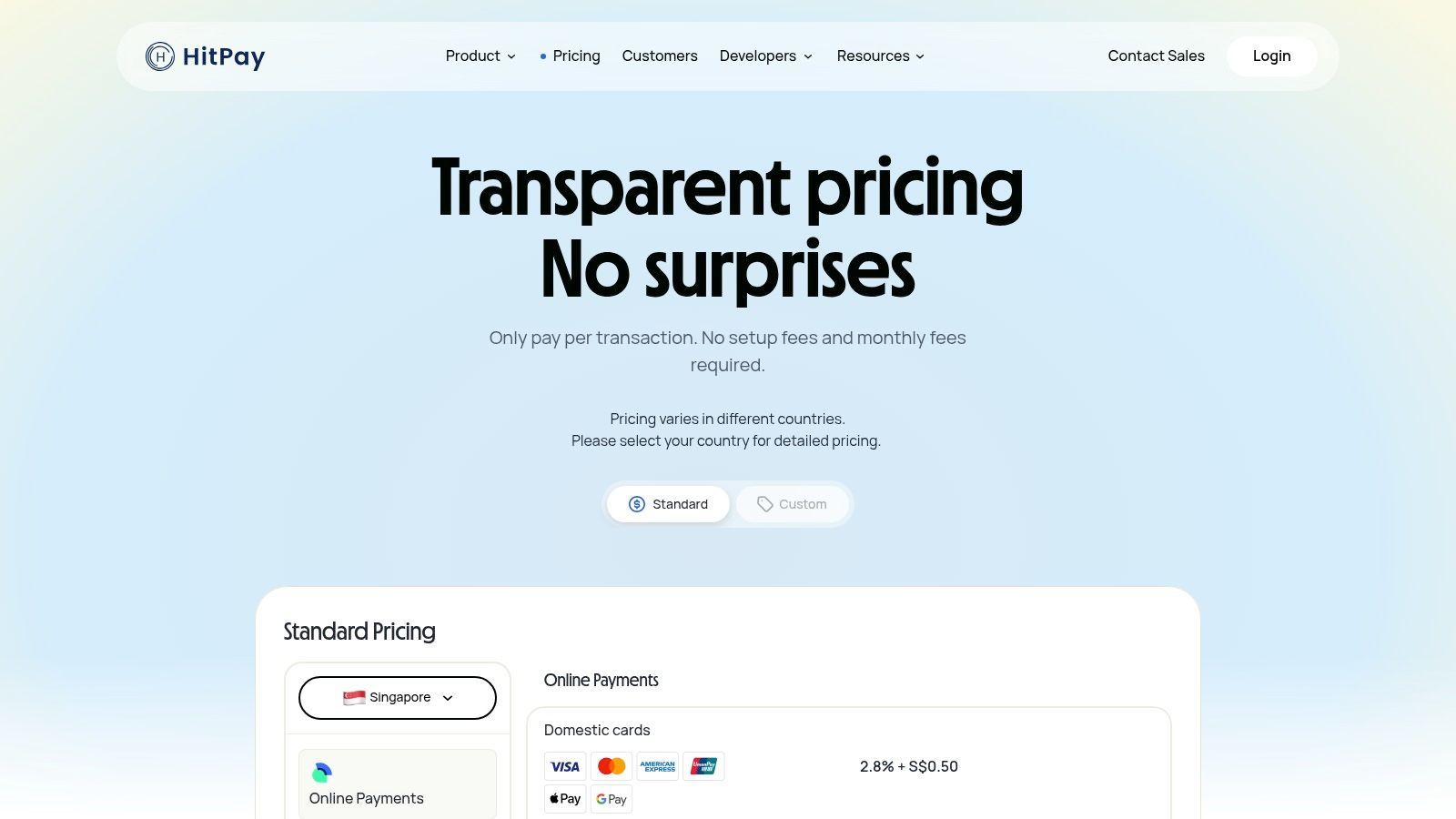

2. HitPay

HitPay is a Singapore-born platform engineered for local businesses. It offers a straightforward pay-per-transaction model. It’s perfect for new ventures or any business with fluctuating monthly transaction volumes.

HitPay's standout feature is its transparency. The Singapore pricing page lays out all Merchant Discount Rates (MDRs) in plain sight. This clarity makes it one of the most accessible options for local businesses.

Why HitPay Shines for Singaporean SMEs

HitPay removes the complexity of payment processing. There are no setup fees, no monthly charges, and no minimum sales requirements. You only pay when you make a sale.

It enables Tap to Pay on both iPhone and Android. This turns your smartphone into a card terminal without extra hardware. This is valuable for mobile businesses like food trucks and market vendors.

Calculating Your True Cost with HitPay

Because the MDRs are published, you can quickly estimate expenses. This gives you immediate insight into your net revenue per transaction.

Be aware of situational costs. Transactions involving international cards will incur higher fees. Businesses catering heavily to tourists should factor these surcharges into their pricing.

Pro Tip: Use HitPay's free online payment gateway calculator. It helps you estimate your monthly costs based on expected sales volume.

The Verdict

For a Singaporean small business prioritising low startup costs and flexibility, HitPay is an exceptional choice. It empowers you to accept a wide range of payments with minimal financial commitment.

Pros:

S$0 setup and monthly fees.

Publicly listed, clear MDRs for easy cost calculation.

Supports modern solutions like Tap to Pay on mobile.

Cons:

Higher fees for international cards can affect tourist-focused businesses.

Add-on features may increase the effective rate.

Ready to start? Visit their website: https://hitpayapp.com/pricing/sg

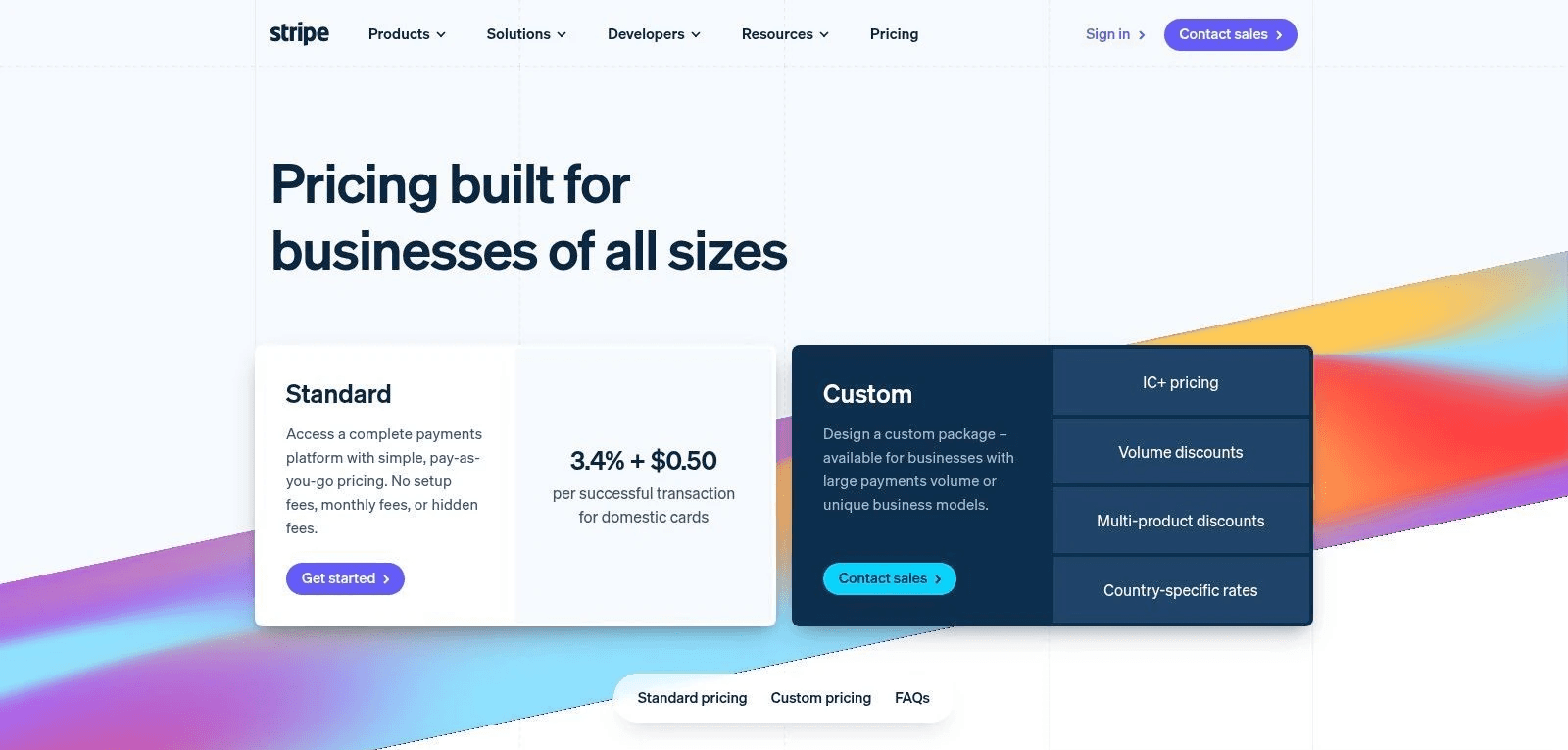

3. Stripe

Stripe offers a powerful, unified platform for businesses that operate both online and in-person. It provides extensive tools while maintaining a simple pay-as-you-go pricing model. It's an excellent choice for merchants who need robust omnichannel capabilities.

Stripe's major advantage is its clear pricing page. You can immediately see the per-transaction fee (e.g., 3.4% + S$0.50) for card payments. This allows for straightforward cost projections.

Why Stripe Works for Omnichannel Businesses

Stripe bridges the gap between your e-commerce store and physical retail. There are no setup fees or monthly charges on their standard plan. You only pay for the transactions you process.

Their support for modern payment methods is comprehensive. Stripe supports Tap to Pay on both iPhone and Android. This is perfect for retailers who want a single provider for their online store and pop-up stall.

Calculating Your True Cost with Stripe

The headline rate gives you a solid baseline for expenses. However, add-ons can influence the final cost. Using Tap to Pay adds a per-authorisation fee on top of the standard rate.

Note the higher fees for international cards and currency conversions. Businesses with a significant international customer base must account for these uplifts. Stripe's reporting tools make it easy to track transaction types.

Pro Tip: Dive into Stripe's extensive documentation. You might find a pre-built connection to your existing accounting or CRM software.

The Verdict

For a Singaporean business prioritising scalability and a unified platform, Stripe is a top-tier contender. It provides the power of a global payment giant with a transparent, pay-per-transaction model.

Pros:

S$0 setup and monthly fees on the standard plan.

Excellent for businesses needing a single provider for online and in-person payments.

Broad integrations and powerful developer tools.

Cons:

Headline MDR can be higher than some local-only providers.

Per-authorisation fees for features like Tap to Pay can increase costs.

Ready to start? Visit their website: https://stripe.com/en-sg/pricing

4. Qashier

Qashier offers an all-in-one solution for businesses needing more than just payment processing. It bundles a full Point of Sale (POS) system with integrated payments. It's ideal for retail shops or cafes that manage inventory and staff.

Qashier's website clearly outlines pricing for different software tiers and hardware. This allows you to build a package that fits your budget. This transparency in total cost makes it a strong contender.

Why Qashier Shines for Growing Businesses

Qashier is designed for businesses ready to scale. Their tiered subscriptions unlock features like inventory management and employee tracking. You can start small and grow into a more robust system without switching providers.

The primary benefit is having a single point of contact for your sales operation. Qashier consolidates your POS software, hardware, and payment processor. This simplifies support and ensures seamless integration.

Calculating Your True Cost with Qashier

Calculating your total cost involves three components: hardware, software, and the Merchant Discount Rate (MDR). Qashier publishes its hardware prices and monthly software fees.

The MDR is presented as a range (e.g., from 1.9% to 3%), as the final rate depends on your business profile. Higher-tier plans or higher sales volumes can often unlock lower MDRs.

Pro Tip: When evaluating Qashier, map out your must-have POS features first. Choose the software tier that meets those needs, then add the hardware cost and projected MDR.

The Verdict

For a Singaporean business needing an integrated POS and payments system with clear pricing, Qashier is an outstanding choice. It's built for merchants who value operational efficiency.

Pros:

Transparent hardware and software subscription costs.

All-in-one system simplifies vendor management.

Preferential MDRs are available for higher-tier plans and volumes.

Cons:

Subscription and hardware costs may be too high for very low-volume sellers.

The exact MDR is determined after a merchant assessment.

Ready to start? Visit their website: https://qashier.com/sg/

5. GrabMerchant

For merchants in the Grab ecosystem, Tap to Pay on iPhone is a massive leap forward. This solution transforms a compatible iPhone into a payment terminal, eliminating extra hardware. It’s a low-friction way to start accepting contactless card payments.

The biggest draw is its seamless integration and hardware-free setup. If you already use the GrabMerchant app, enabling card acceptance is a simple step. This makes it a strong contender for businesses prioritising simplicity.

Why GrabMerchant Shines for Existing Users

GrabMerchant’s Tap to Pay feature is designed for convenience. There is no extra hardware to buy or rent and no separate app to manage. You can accept contactless card payments directly on your iPhone (XS or newer).

The platform often runs attractive launch promotions. New users might benefit from a limited-time zero-MDR offer. This makes it an almost risk-free trial for any curious merchant.

Calculating Your True Cost with GrabMerchant

The initial promotional period offers fantastic value. This is an unbeatable offer to get started and understand your transaction patterns.

However, a key consideration is the lack of publicly listed ongoing MDRs. After the promotional period, your specific rates will be provided during the application process. This makes direct, upfront comparison with other services challenging.

Pro Tip: During the promotional period, track your transaction volume and average sale amount. This data will be invaluable when Grab provides your ongoing rate.

The Verdict

For Singapore-based businesses heavily reliant on the Grab ecosystem, adding Tap to Pay is a logical next step. It consolidates payments into a single app and removes hardware costs.

Pros:

S$0 hardware cost; uses your existing iPhone.

Unified platform for QR, e-wallet, and card payments.

Promotional offers provide a risk-free trial period.

Cons:

Ongoing MDRs are not publicly listed, requiring application to see rates.

Requires a compatible iPhone (XS or newer) with the latest iOS.

Ready to start? Visit their website: https://www.grab.com/sg/merchant/payment-solutions/tap-to-pay-on-iphone/

Frequently Asked Questions (FAQ)

What is the cheapest way to accept credit card payments in Singapore?

For micro-businesses and mobile vendors, a SoftPOS solution like nashi is often cheapest. These apps turn your phone into a terminal, eliminating hardware rental and monthly fees. You only pay a small percentage per transaction.

Do I need a special machine to accept credit cards?

Not anymore. Modern "Tap to Phone" or SoftPOS technology lets you accept contactless payments directly on a compatible NFC-enabled smartphone. This is ideal for new businesses wanting to avoid the cost and complexity of traditional terminals.

What are typical credit card processing fees in Singapore for 2026?

Fees vary, but for small businesses, a flat rate between 1.99% and 3.5% plus a small fixed fee (e.g., S$0.50) per transaction is common. High-volume businesses may qualify for lower, custom rates. Always check for hidden monthly or setup fees.

Can I accept credit cards without a registered business?

Most legitimate payment processors require you to have a registered business entity (e.g., Sole Proprietorship, Pte. Ltd.) in Singapore. This is necessary for compliance and to set up a merchant account for receiving funds.

How to Choose Your Perfect Match in 2026

Feeling overwhelmed? Let's simplify the decision. Your next step is to identify which category you fall into and focus your evaluation there.

For the Mobile Entrepreneur (Pop-ups, Pop Up Stalls, Freelancers):

Your concerns are portability, low startup costs, and simplicity. A hardware-free SoftPOS solution is your most cost-effective path.

Your Best Bet: Look at nashi or GrabMerchant's Tap to Pay. They eliminate terminal fees and have competitive flat-rate pricing.

For the Growing Small Business (Boutiques, Cafes, Retailers):

You have a physical location with an e-commerce and growing sales. You need a reliable system for in-person and digital payments.

Your Best Bet: Compare a versatile flat-rate provider like HitPay or Stripe against an integrated POS system like Qashier. Calculate your effective rate with each to see the true cost.

For the Established Merchant (High-Volume Retail, Online Stores):

Your focus is on shaving fractions of a percent off processing costs. Transparency and detailed reporting are non-negotiable.

Your Best Bet: You are a prime candidate for custom pricing. Investigate providers like Stripe for their high-volume plans or contact enterprise-focused gateways for a tailored quote.

Key Insight: The "perfect" solution can be a moving target. Choose the most cost-effective and flexible option for your business today. Re-evaluate your choice every 12-18 months as your business grows.

The search for the cheapest credit card processing services of 2026 is a strategic business decision. By focusing on your total cost and matching the pricing model to your sales patterns, you are setting your business up for financial success.

Ready to eliminate terminal costs? For new entrepreneurs and pop-up vendors in Singapore, the most direct path to low-cost processing is a SoftPOS solution. nashi turns your phone into a payment terminal with no hardware and no monthly fees.

Find out why it’s the smart choice for agile businesses at nashi and start accepting payments in minutes.