nashi Team

5 min read

Are you a Singaporean business owner tired of clunky hardware and long contracts just to accept a card payment? Many micro-businesses, from pop-up stalls to freelance tutors, rely on PayNow. This often means missing out on sales from tourists or customers who prefer to tap their card.

A new wave of mobile payment apps is changing the game. These solutions, called 'SoftPOS' or 'Tap to Phone' or 'Tap to Pay on iPhone', turn your smartphone into a payment terminal. There’s no need to buy, rent, or maintain a separate card reader.

This guide breaks down the best mobile POS systems in Singapore that are fast to set up and transparently priced. We’ll dive into each platform so you can find the perfect fit and get paid faster without the overhead.

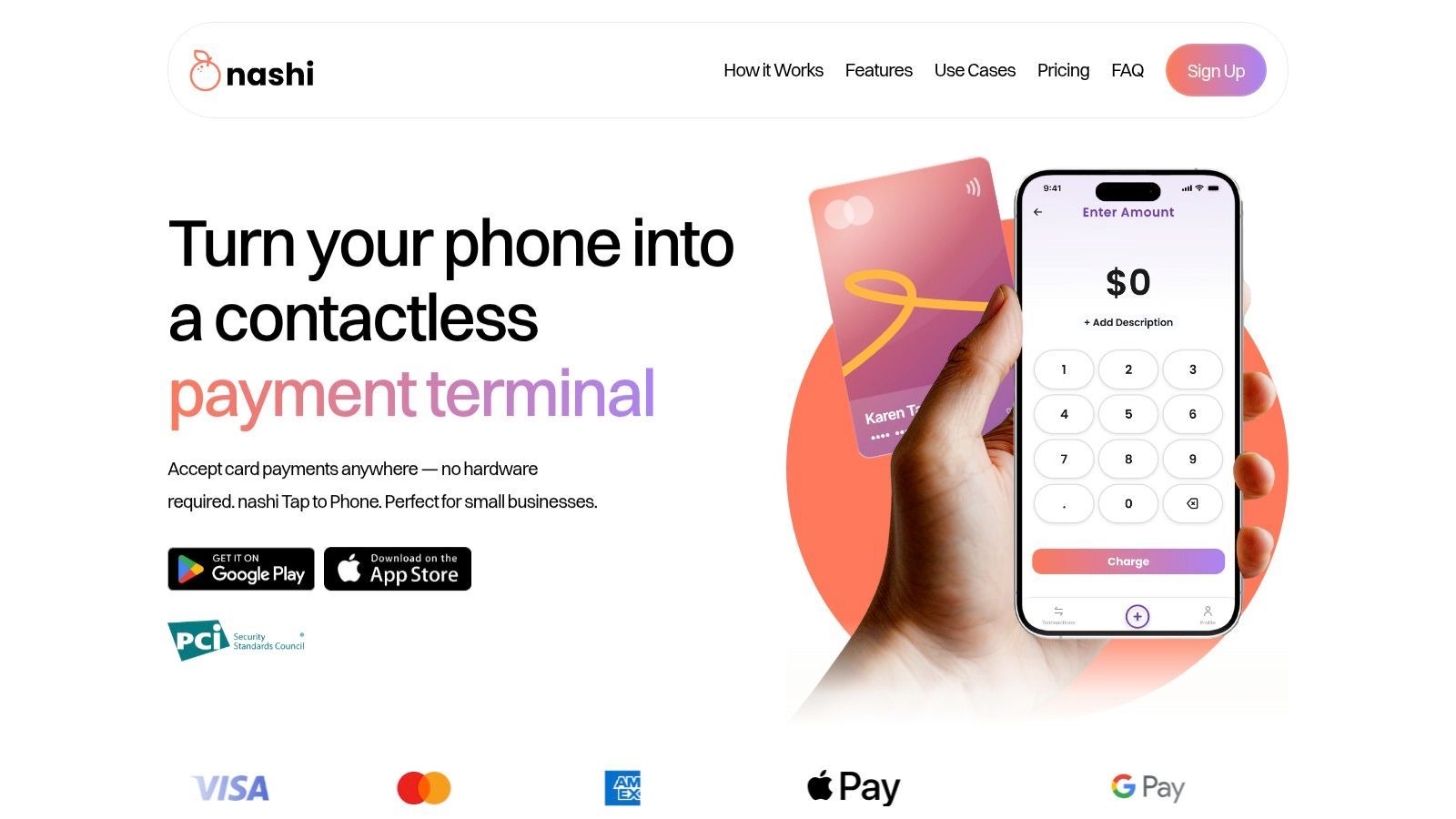

1. nashi

Best For: Hardware-free, instant card acceptance for micro-businesses.

For Singapore’s entrepreneurs and mobile service providers, nashi delivers an elegant solution. It transforms your NFC-enabled smartphone into a contactless payment terminal. This means no clumsy card readers, Bluetooth pairing, or extra hardware.

nashi is purpose-built for businesses that need to accept in-person card payments quickly. It avoids the feature bloat of traditional POS systems, focusing only on a fast and secure Tap-to-Phone experience.

Why It Stands Out as a Top Choice

The onboarding process is a game-changer. It’s entirely digital, with most accounts approved in about one business day. This allows you to start accepting payments almost immediately.

The app is incredibly straightforward, with a payment flow that takes seconds. It also offers real-time transaction tracking and simple one-tap refunds.

Powered by enterprise-grade payment rails from Adyen, nashi offers small businesses top-tier security. Automatic settlements arrive in your bank account in approximately two business days.

Pricing & Key Features

nashi’s pricing is transparent and suited for businesses with fluctuating sales. There are no monthly subscription fees, no contracts, and no terminal rental costs. You only pay for the transactions you process.

Feature | Details |

|---|---|

Transaction Fees | Starts at 1.99% + S$0.300 (first-time card acceptors) Standard rate: 2.7% + S$0.30 |

Risk Free Trial | First S$1,000 in transactions fee-free (limited time offer) |

Onboarding Speed | Fully digital, ~1 business day |

Hardware Requirement | None (NFC-enabled Android or supported iPhone) |

Core Functionality | Tap-to-Phone, real-time tracking, digital receipts, refunds |

Security | PCI-DSS compliant, powered by Adyen |

This structure provides predictability and complements PayNow, giving customers the choice to pay by card.

Pros

Truly hardware-free

Lightning-fast onboarding

No fixed costs or lock-ins

Enterprise-grade security

Cons

Not a full POS system

Requires a compatible smartphone

Discover how you can start accepting card payments without any hardware by exploring the details on their official site.

2. HitPay

HitPay is a homegrown solution built for local needs in Singapore. The platform delivers a powerful mobile POS experience that turns your smartphone into a payment terminal, eliminating the need for extra hardware.

HitPay’s strength is its simplicity and comprehensive payment acceptance. Using Tap to Pay, you can accept contactless cards (Visa, Mastercard, AMEX, UnionPay) and digital wallets instantly. It also integrates seamlessly with PayNow QR.

Key Features & Pricing

The platform offers a free app with straightforward, pay-per-transaction pricing. Onboarding is quick and HitPay is registered with the Monetary Authority of Singapore (MAS). This provides peace of mind that comes with local regulatory oversight.

Best For: Pop-ups, market vendors, and mobile service providers needing fast, hardware-free setup

Key Standout: Local focus with PayNow QR and MAS registration

Pricing: Pay-per-transaction, no monthly fees

While its inventory tools are basic, they are perfect for merchants who prioritise speed. HitPay provides an unbeatable combination of local trust, speed, and simplicity.

Check out HitPay: https://hitpayapp.com

3. GrabMerchant

For businesses in the Grab ecosystem, GrabMerchant offers a seamless way to accept in-person payments. This solution allows merchants to use Tap to Pay on iPhone to accept contactless cards and digital wallets. It’s ideal for a cafe that uses GrabFood or a small retailer consolidating their tools.

GrabMerchant's strength is its simplicity for existing users. The app-based onboarding is quick, and the system supports PIN entry directly on the iPhone for secure transactions. This hardware-free approach is convenient for merchants starting out.

Key Features & Pricing

The platform stands out with occasional promotional merchant discount rate (MDR) rebates. Integration within the broader Grab app provides a connected experience for businesses. This helps manage deliveries and in-store sales together.

Best For: Existing GrabFood or GrabMart merchants wanting to unify their in-person and online payment systems.

Key Standout: Deep integration with the Grab ecosystem and strong brand familiarity in Singapore.

Pricing: Transaction-based from 2.5% + GST with occasional promotional rates and rebates available.

The feature set for in-person payments is less advanced than dedicated POS suites. However, it perfectly serves merchants who prioritise convenience and ecosystem synergy.

Check out GrabMerchant: https://www.grab.com/sg/merchant/payment-solutions/tap-to-pay-on-iphone/

4. Fiuu

Fiuu (formerly Razer Merchant Services) offers a compelling solution for businesses with a regional footprint. It transforms your iPhone into a terminal through its Virtual Terminal app. This is perfect for event vendors or merchants who want a professional card acceptance flow without hardwar

Fiuu’s strength is its enterprise-grade technology in a simple package. The platform enables fast onboarding for accepting major contactless cards and digital wallets. Its support for PIN entry on the iPhone screen ensures you can handle higher-value transactions securely.

Key Features & Pricing

The platform focuses on pure payment acceptance. This makes it ideal for merchants who already have a POS system and need a mobile payment add-on. Integrations with existing regional POS partners allow Fiuu to plug into your current workflow.

Best For: Established businesses, event merchants, and retailers with existing POS systems needing a mobile payment add-on.

Key Standout: Phone-native Tap to Pay with PIN support and strong regional presence across Southeast Asia

Pricing: Custom pricing model; requires direct contact with the Fiuu sales team for specific rates.

While you won't find deep inventory management, Fiuu excels at its core function: fast, secure mobile payments. For a business that values a polished customer experience, Fiuu is a top-tier contender.

Check out Fiuu: https://fiuu.com/tap-to-pay-on-iphone

5. Revolut Business

Revolut Business offers an integrated solution combining banking and payments. It leverages Tap to Pay on iPhone directly within its app. This is an excellent choice for entrepreneurs who want to manage finances and accept payments from one platform.

The primary appeal of Revolut is its all-in-one nature. You can accept contactless payments that settle directly into your multi-currency business account. This streamlined workflow is ideal for managing cash flow and simplifying bookkeeping.

Key Features & Pricing

Getting started is quick for existing Revolut Business customers. The platform has transparent, publicly available pricing for Tap to Pay transactions. It requires a full Revolut Business account, which provides tools like international transfers and expense management.

Best For: Existing Revolut users, freelancers, and consultants needing an all-in-one banking and payment solution.

Key Standout: Seamless integration of Tap to Pay functionality within a comprehensive multi-currency business account. (Banking + payments in one app)

Pricing: Pay-per-transaction starting from 2.8% + S$0.60 plus GST as well as various monthly subscription tiers for core business account

While its POS features are basic, its strength is convenience. Revolut Business is an efficient option for those who value a consolidated financial dashboard.

Check out Revolut Business: https://www.revolut.com/en-SG/news/revolut_launches_tap_to_pay_on_iphone_for_businesses_in_singapore/

6. Shopify POS

For merchants on Shopify, the Shopify POS system unifies online and in-person sales. It transforms your Android device into a powerful retail hub. This is perfect for boutiques expanding into physical pop-ups.

Shopify POS excels with deep retail features like inventory management and customer profiles. In Singapore, it supports Tap to Pay on compatible Android devices. This allows for quick, hardware-free transactions.

Key Features & Pricing

The system is built to scale, from a single device to a multi-location chain. It requires a paid Shopify plan, but the value is its unified ecosystem. Your online catalogue, inventory, and sales data are always in sync.

Best For: Existing Shopify e-commerce merchants and retailers needing a scalable, omni-channel solution and expanding offline.

Key Standout: Flawless integration between online store and physical sales, creating a single source of truth.

Pricing: Shopify plans from S$38/month; POS Pro add-on available from S$115/mont per location for advanced features

The total cost can be higher than standalone apps. However, for a business aiming for growth, Shopify POS provides a professional-grade platform that grows with you.

Check out Shopify POS: https://www.shopify.com/sg/pos

7. Stripe Terminal Tap to Pay

For businesses in the Stripe ecosystem, Stripe Terminal offers a powerful approach to in-person payments. It enables Tap to Pay on compatible devices through its SDKs. This is ideal for tech-savvy merchants wanting a custom checkout experience.

The core advantage of Stripe Terminal is its customisability. Stripe provides the building blocks (SDKs and APIs) for businesses to create a tailored payment flow. This allows for deep integration with existing inventory systems, booking platforms, and CRM software.

Key Features & Pricing

Stripe Terminal is a platform that powers POS apps, not a standalone app itself. Its strength is a developer-first approach, offering flexibility for businesses that want control. Pricing is transaction-based, though fees can vary.

Best For: Tech-forward businesses using Stripe. Businesses with developer resources, SaaS platforms, and merchants already using Stripe for online payments.

Key Standout: Highly customisable APIs. Extreme flexibility through SDKs and APIs for custom POS integrations and unified reporting.

Pricing: Transaction-based from 3.4% + S$0.50 additional fees may apply such as Tap to Pay may have a small per-authorisation fee in addition to standard card processing fees.

It's not a plug-and-play solution for non-technical users. However, its reliability and scalability make it a top choice for growing businesses that prioritise customisation.

Check out Stripe Terminal: https://stripe.com/en-sg/terminal/tap-to-pay

Top 7 Mobile POS Systems in Singapore — Feature Comparison

Solution | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal User Case | Key Advantages |

|---|---|---|---|---|---|

nashi | Very low — fully digital onboarding (~1 business day) and plug‑and‑play SoftPOS | NFC‑enabled smartphonewith supported OS; internet; bank account | Fast in‑person card acceptance, ~2 business day settlements, low operational cost | Micro/small businesses, pop‑ups, food trucks, freelancers | Hardware‑free SoftPOS, Adyen rails, PCI‑DSS compliance, transparent pricing and risk‑free trial |

HitPay | Low — app onboarding with basic POS features | iOS/Androidsmartphone (Tap to Pay), internet | Quick card acceptance plus simple inventory and reporting | Mobile sellers, market stalls, small merchants, e-commerce businesses | Local MAS registration, clear pricing, PayNow support |

GrabMerchant | Low — app onboarding inside Grab ecosystem | iPhone with Tap to Pay, Grab merchant account | Contactless acceptance with ecosystem promotions and PIN support | Merchants already using Grab services, quick local deployments | Brand familiarity, ecosystem support, occasional MDR promos |

Fiuu | Low to moderate — virtual terminal plus partner integrations | iPhone with Tap to Pay on iPhone, possible POS integration partners | Hardware‑free acceptance with regional POS connectivity | Pop‑ups and mobile sellers across SEA, merchants needing integrations | iPhone‑native flow, regional coverage, POS partner integrations |

Revolut Business | Low if already a Revolut Business customer; requires business onboarding | iPhone with Tap to Pay, Revolut Business account | Combined payments and multi‑currency banking, transparent fees | Small teams wanting banking and payments in one app, multi‑currency sellers | Unified business account, payouts and FX, visible fee tables |

Shopify POS | Moderate — requires Shopify plan and POS setup | Android (Tap to Pay in SG) or optional hardware; paid Shopify plan and add‑ons | Unified online and in‑store management, robust inventory and analytics | Merchants with online stores needing omni‑channel retail features | Deep retail features, omni‑channel reporting, large app/hardware ecosystem |

Stripe Terminal Tap to Pay | Moderate to high — SDKs or partner integration often needed | Developer resources or partner, smartphone or certified readers, Stripe account | Flexible payments stack, unified Stripe reporting, scalable integrations | Businesses with developer resources or existing Stripe usage | Powerful APIs/SDKs, flexible hardware options, enterprise‑grade reliability |

Finding the Right Mobile POS for Your Singapore Business

The search for the best mobile POS systems in Singapore reveals a simple truth: there's a perfect fit for every business. The key is aligning the tool's strengths with your operational needs.

For retailers on Shopify, Shopify POS is a seamless choice. For F&B businesses in the Grab ecosystem, GrabMerchant is an intuitive extension. For tech-forward businesses needing customisation, Stripe Terminal offers great flexibility.

However, for pop-ups, market vendors, and new entrepreneurs, the priority is different. You need a fast, reliable, and affordable way to accept card payments on your phone. This should complement your existing PayNow QR code.

This is where a dedicated SoftPOS app shines. These tools focus on turning your smartphone into a payment terminal. By stripping away unneeded features, they offer fast onboarding, no hardware, and transparent pricing.

Choosing your mobile POS is a pivotal step. It's about enhancing your customer experience and unlocking new revenue. Armed with this guide, you can make a confident choice to energise your business.

Frequently Asked Questions

What is a mobile POS system?

A mobile POS (Point of Sale) system is an app that turns a smartphone or tablet into a cash register. For the apps in this list, it specifically means using your phone's built-in NFC chip to accept contactless card payments without any extra hardware.

Do I need to buy a card reader?

No. All the systems on this list use "Tap to Phone" or "SoftPOS" technology. This means your compatible smartphone (like an NFC-enabled Android or a modern iPhone) acts as the terminal itself, so no separate card reader is required.

How quickly can I start accepting payments?

Onboarding speed varies, but solutions like nashi are designed for speed. They often approve fully digital applications within one business day, allowing you to start taking payments almost immediately after signing up.

Are mobile POS systems secure?

Yes. These platforms are built by major payment companies (like Adyen, Stripe, and Shopify) and must adhere to strict security standards like PCI-DSS. Transactions are encrypted, and customer card data is never stored on your device, making it as secure as a traditional terminal.

Ready to start accepting card payments in minutes, with no hardware and no hidden fees? See why nashi is the go-to choice for Singapore's agile small businesses. Get started with nashi today and turn your phone into your most powerful sales tool.